A limited partnership (LP)—not to be confused with a limited liability partnership (LLP)—is a business owned by two or more parties. These must include at least one general partner who runs the business and has unlimited liability for any debts. The limited partners have liability only up to the amount of their investment.

The limited partnership business structure is often used as a vehicle for individuals who pool their money to invest in real estate or other assets.

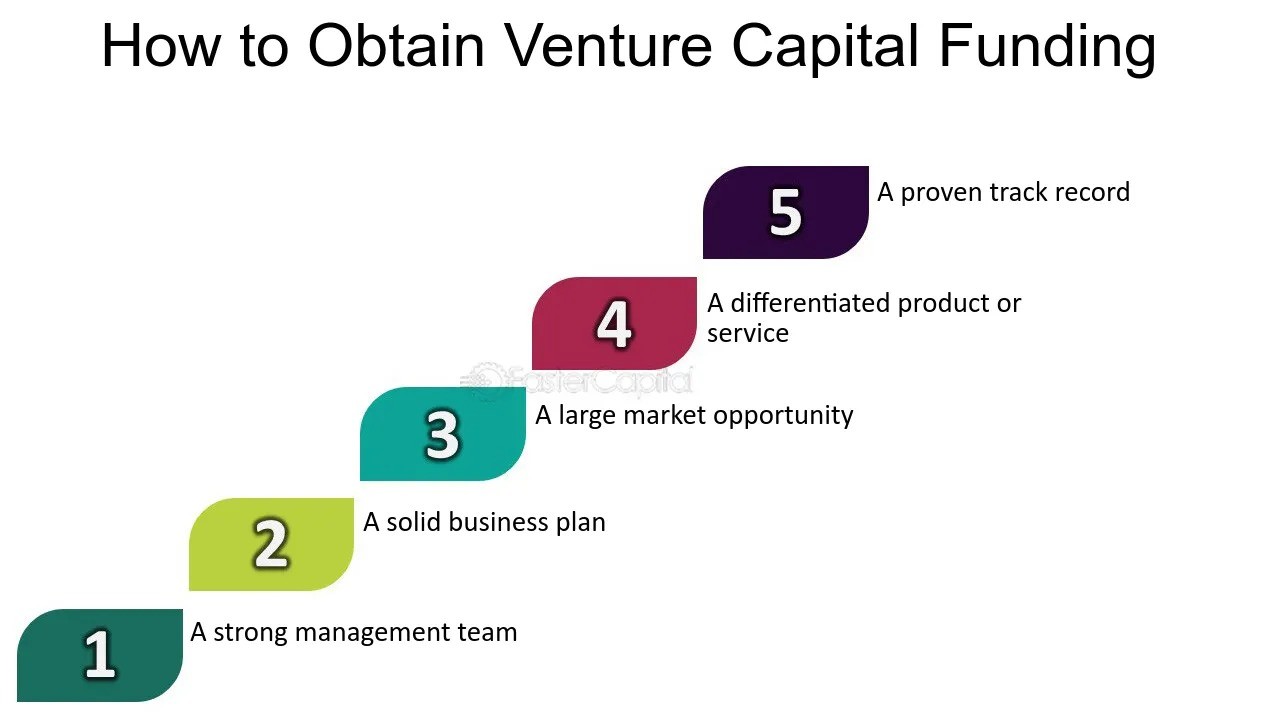

Understanding venture capital (VC)

VCs fund startups and small firms with high growth potential. Financing options include private equity (PE) and skills (e.g., technical or managerial).

VC agreements often entail creating huge ownership stakes in a firm and selling them to a select group of investors via independent limited partnerships. These ties are formed by venture capital companies and may include a group of comparable businesses.

One significant distinction between venture capital and other private equity deals is that venture capital focuses on emerging companies seeking significant funds for the first time, whereas PE funds larger, more established companies seeking an equity infusion or the opportunity for company founders to transfer some of their ownership stakes.

Despite the danger, venture capitalists are generally drawn to opportunities with above-average returns. For young enterprises or projects with short operational experience (under two years), venture capital (VC) is becoming a popular and vital source of funding, particularly for those without access to capital markets, bank loans, or other debt instruments.2The biggest disadvantage is that investors often get shares in the firm and so have a vote in its choices.

History of Venture Capital.

Venture capital is a subcategory of private equity. While the origins of PE may be traced back to the nineteenth century, VC emerged as an industry after WWII.

Harvard Business School professor Georges Doriot is widely regarded as the "Father of Venture Capital." He founded the American Research and Development Corporation in 1946 and funded $3.58 million to invest in firms that exploited WWII technology.31

The corporation's initial investment was in a business that planned to employ x-ray technology to cure cancer. Doriot's $200,000 investment grew into $1.8 million when the business went public in 1955.1

Hit by the 2007-2008 financial crisis.

The VC sector was affected by the 2007-2008 financial crisis. Venture capitalists and other institutional investors, who provided funding for many startups and small businesses, tightened their purse strings.4

Following the Great Recession, the unicorn emerged. A unicorn is a private startup with a valuation more than $1 billion.5

TechCrunch. "Welcome to the Unicorn Club: Learning from Billion-Dollar Startups."In a low-interest-rate environment, these enterprises attracted investors such as sovereign wealth funds (SWFs) and huge private equity firms looking for high profits. Their arrival caused changes to the venture capital ecosystem.6

Westward Expansion

Although it was first backed mostly by Northeastern banks, venture capital became focused on the West Coast as the tech sector expanded. Fairchild Semiconductor was founded by eight engineers (the "traitorous eight") from William Shockley's Semiconductor Laboratory and is often regarded as the first technological firm to obtain venture capital backing. It was supported by east coast businessman Sherman Fairchild of Fairchild Camera & Instrument Corp.7.

Arthur Rock, an investment banker with Hayden, Stone & Co. in New York City, facilitated the transaction and later founded one of Silicon Valley's early venture capital companies. Davis & Rock backed some of the most powerful technological firms, including Intel and Apple.7By 1992, 48% of all investment expenditures flowed to West Coast enterprises, while Northeast Coast industries accounted for just 20%.8

According to Pitchbook and the National Venture Capital Association, the situation has not altered much. In 2022, West Coast corporations accounted for more than 37% of all agreements (but about 48% of deal value), while the Mid-Atlantic area saw just about 24% of all deals (and about 18% of all deal value).9