What are Venture Capital Funds?

Venture capital funds are pooled investment funds that manage the money of investors who seek private equity stakes in startups and small- to medium-sized enterprises with strong growth potential. These investments are generally characterized as very high-risk/high-return opportunities.

Understand Venture Capital Funds

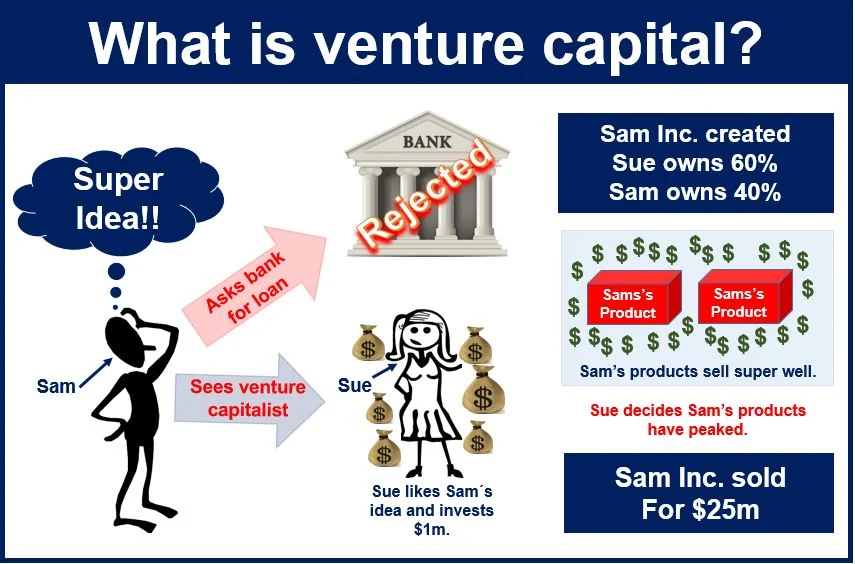

Venture capital (VC) is a kind of equity financing that allows entrepreneurs or other small businesses to acquire funds before they begin operations or generate revenue or profits. Venture capital funds are private equity investment entities that attempt to invest in high-risk, high-return companies based on their size, assets, and stage of product development.

Venture capital funds vary fundamentally from mutual funds and hedge funds in that they concentrate on a single form of early-stage investment. All venture capitalists invest in companies with strong growth potential, risk, and a lengthy investment horizon. Venture capital funds get increasingly involved with their investments, offering assistance and even holding board seats. As a result, venture capital firms are actively involved in the management and operations of the businesses in their portfolio.

Venture capital funds' portfolio performance mimic a barbell strategy to investing. Many of these funds place tiny stakes on a diverse range of fledgling firms, hoping that at least one would achieve rapid development and repay the fund with a comparably significant payment in the end. This helps the fund to reduce the likelihood that certain investments may fail.

Running a Venture Capital Fund

Venture capital investments are classified as seed capital, early-stage capital, or expansion-stage finance based on the maturity of the firm at the time of investment. However, regardless of investment level, all venture capital funds operate and are governed in the same manner.

Venture capital funds, like all other pooled investment funds, must obtain cash from outside investors before making their own investments. Potential investors in the fund are given a prospectus, after which they commit money to it. All prospective investors who commit are contacted by the fund's operators, and individual contribution amounts are settled.

From there, the venture capital fund seeks private equity investments with the potential to generate significant positive returns for its investors. This often entails the fund's manager or managers reviewing hundreds of company proposals in search of possibly high-growth businesses. The fund managers base their investing choices on the prospectus instructions and the fund's investors' expectations. After an investment, the fund charges an annual management fee, which is typically approximately 2% of assets under management (AUM), however certain funds may not charge a fee unless it is based on profits produced. Management fees assist pay for the general partner's wages and costs. Fees for big funds may be imposed exclusively on invested money or decrease after a specified number of years.

Venture Capital Fund Returns

Investors in venture capital funds profit when a portfolio business exits, either via an IPO or a merger and acquisition. Two and twenty (or "2 and 20") is a frequent fee structure used in venture capital and private equity. The "two" represents 2% of AUM, and the "twenty" represents the usual performance or incentive fee of 20% of profits earned by the fund over a set benchmark. If the exit generates a profit, the fund retains a part of the profits—typically 20%—in addition to the yearly management charge.

Though predicted returns vary depending on sector and risk profile, venture capital firms usually seek a gross internal rate of return of roughly 30%.

Venture Capital Firms and Funds.

Venture capitalists and venture capital firms invest a wide range of enterprises, including dotcoms, biotechs, and peer-to-peer lending companies. They typically establish a fund, accept money from high-net-worth people, organizations seeking alternative investment exposure, and other venture funds, and then invest that money in a number of smaller firms known as the VC fund's portfolio companies.

Venture capital firms are raising more money than ever before. According to financial data and software business PitchBook, the venture capital sector has spent a record $136.5 billion in American companies by the end of 2019.

According to PitchBook, the overall number of venture capital transactions this year was approximately 11,000, a record high. Two notable agreements were Epic Games' $1.3 billion financing round and Instacart's $871.0 million Series F. According to Pitchbook, fund sizes have increased, with the median fund size being about $82 million, and 11 funds finished out the year with $1 billion in commitments, including Tiger Global, Bessemer Partners, and GGV.